Bank

I want to…

Earn, save and give back.

Put aside funds you'll have access to anytime, with competitive interest, no monthly account fee, and deposits that support positive change in your community.

Learn moreBorrow

Startup loans for…

CEBA loans.

Find repayment deadlines, how-tos and other information about your CEBA loan.

Learn moreInvest

I need…

I want to…

Earn, save and give back.

Put aside funds you'll have access to anytime, with competitive interest, no monthly account fee, and deposits that support positive change in your community.

Learn moreBank

Business accounts

Credit cards

Ways to bank

Resources for my business

Book an appointment

Explore business banking

Borrow

Loans and mortgages

Resources for my business

Find a business account manager

Explore lending and advice

Invest

Term deposits

Mutual funds, stocks and bonds

Online trading

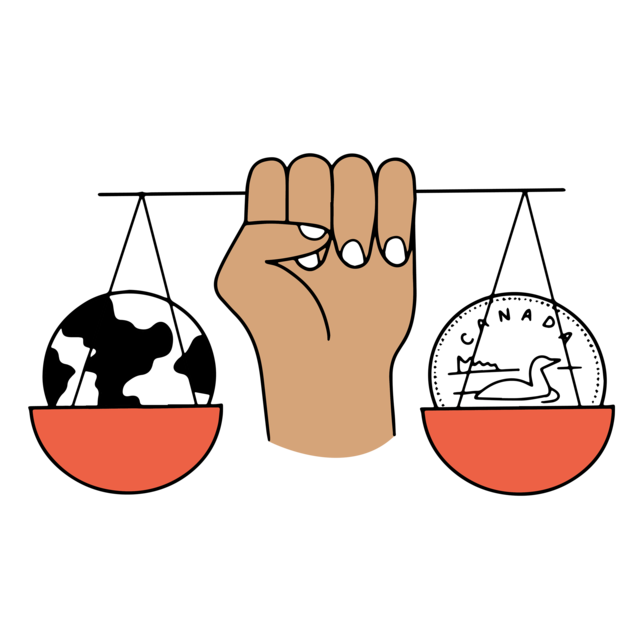

Socially responsible investments

Meet with a wealth management professional

See all investments

Impact